All receipts with Cash or Cheque payment types are recorded in a virtual cash account (Account 115) until the final destination of the money is defined:

- Deposit to physical cash (Account

111) - Deposit to bank

- Used for expense payment

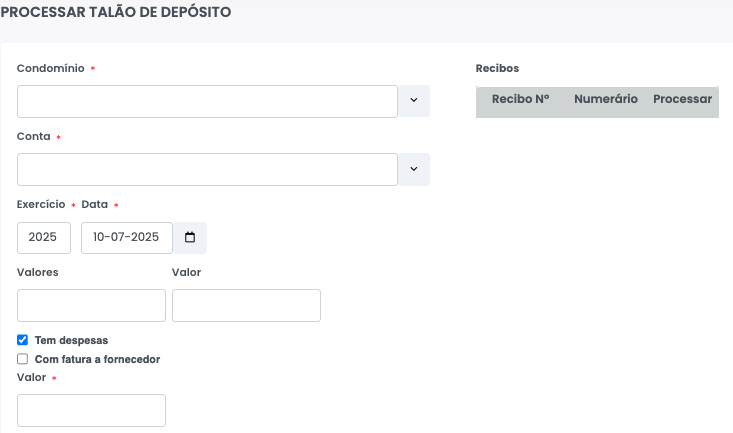

💼 How to process a deposit slip?

Go to:

Accounting > Deposit Slips > Process Deposit Slip

📋 Steps to follow:

-

Select the co-owner

→ The pending cash receipts will appear in the receipt grid -

Select the receipts that were used in the transaction you are going to record

-

Specify the destination of the money:

-

If it was deposited in physical cash or bank:

- Select the destination account

- Enter the total amount of cheques (if applicable)

- Enter the total amount of cash

-

If it was used to pay an expense:

- Select the option “Has Expense”

- If the expense already has a recorded invoice:

- Select “With Supplier Invoice”

- Enter the amount used for the payment

-

-

After filling out the form according to the case, click Proceed

✅ This process ensures that the balance in Account 115 is properly allocated to its final destination and that the accounting reflects reality.