Sometimes a unit owner may pay a supplier invoice, and the amount must be recorded as a credit in the system.

🧾 Steps to follow:

1. Register the credit in the owner’s account

- Go to:

Treasury > Receipts > Process Receipt - Receipt Type: Cash

- Description: justify the credit reason

2. Record the supplier’s invoice (if applicable)

- Go to:

Accounting > Supplier Invoices > Process

3. Associate the credit with the invoice or expense

- Go to:

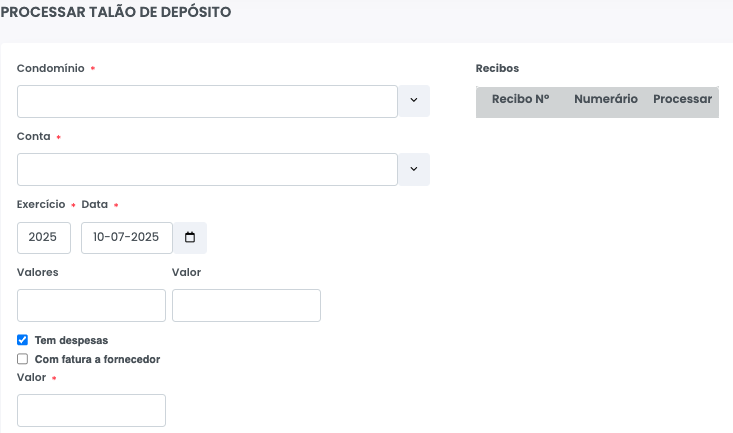

Accounting > Deposit Slips > Process Deposit Slip

- Select the unit owner

- In the receipt grid, select the pending cash receipts

- Choose the appropriate option:

- Has Expense (if there is no invoice)

- With Supplier Invoice (if there is an invoice)

- Enter the amount used to pay the expense

- Complete the remaining fields

- No need to select payment method, as the credit will be used

4. Apply the credit to outstanding debts

- Go to:

Treasury > Receipts > Process Receipt - Create a zero-total receipt, matching:

- The credit movement

- The debts to be offset

- Adjust the values so that the total is zero

✅ This ensures the owner’s credit is correctly registered and can be used to offset future debts.